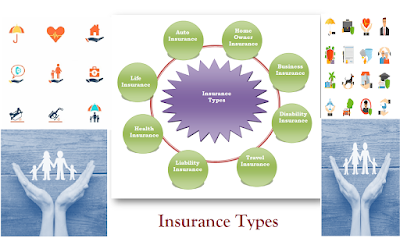

Insuring What Matters: A Closer Look at Essential Insurance Types

Insurance Types Hello Everyone, You know that insurance is an legal binding between you and insurance companies like ( (like LIC, HDFC Life, ICICI Prudential Life etc. ). Read more in my previous article How to Choose Between Insurance and Investment for insurance vs investment. In this article, I will attempt to explain various insurance types. There are several major types of insurance that cover various parts of life. Here are some of the most common types of insurance: Health Insurance: Health insurance pays for medical expenses such as doctor visits, hospital stays, drugs, and operations. It ensures that you can obtain necessary medical care without having to worry about high costs. Life Insurance: Life insurance provides financial security for your loved ones in the event that you die. When you die, it provides a sum of money to your beneficiaries known as a death benefit. This money can be used ...